maryland student loan tax credit application 2021

MHEC Student Loan Debt Relief Tax Credit Program for 2021 Apply by September 15th. Ad Download Or Email App HTCE More Fillable Forms Register and Subscribe Now.

Governor Larry Hogan Official Website For The Governor Of Maryland

Comptroller Peter Franchot urges eligible Marylanders to act fast and apply for the Student Loan Debt Relief Tax Credit Program for Tax Year 2021.

. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents Tax Year 2021 Only Instructions. September 2 2021 Comptroller Peter Franchot urges eligible Marylanders to act fast and apply for the Student Loan Debt Relief Tax Credit Program for Tax Year 2021. There were 9155 Maryland residents who were awarded the 2021 Student Loan Debt Relief Tax Credit.

About the Company 2021 Student Loan Debt Relief Tax Credit Maryland. There were 9155 Maryland residents who were awarded the 2021 Student Loan Debt Relief Tax Credit. The tax credits were divided into two groups of eligibility including Maryland residents who attended a Maryland institution and Maryland residents who attended an out-of-state institution.

Its regrettable that the. From July 1 2022 through September 15 2022. The Student Loan Debt Relief Tax Credit is a program.

Its regrettable that the cost of higher education is preventing many people from pursuing their. Applications must be submitted by September 15. This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit.

Marylands Student Loan Debt Relief Tax Credit can help save you money but you need to act fast. Click Now Choose the Best Personal Student Loans with the Lowest Rates. Student Loan Assistance Programs are for those who make between 30k - 200k Per Year.

This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents. CuraDebt is an organization that deals with debt relief in Hollywood Florida.

This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit. Will have maintained residency within the state of Maryland for the 2020 tax year Have incurred 20000 or more in student loan debt undergraduate or graduate and. The Maryland earned income tax credit EITC will either reduce or eliminate the amount of the state and local income tax that you owe.

September 2 2021 - Comptroller Peter Franchot urges eligible Marylanders to act fast and apply for the Student Loan Debt Relief Tax Credit Program for Tax Year 2021. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible. Ad You Would Qualify for Income-Based Federal Benefits under the Obama Forgiveness Program.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are eligible to apply for the Student Loan Debt Relief Tax Credit. For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refundUnder Maryland law the recipient must. Detailed EITC guidance for Tax Year.

The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who. CuraDebt is an organization that deals with debt relief in Hollywood Florida. Applications must be submitted by September 15.

Use Our Website Pick Your Lender. The Student Loan Debt Relief Tax Credit Program deadline of September 15 is just under two weeks away and Comptroller Peter Franchot and Maryland College Officials are urging students to. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt at the time of applying for the tax credit.

Applications must be submitted by September 15. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. ANNAPOLIS MD Comptroller Peter Franchot urges eligible Marylanders to act fast and apply for the Student Loan Debt Relief Tax Credit Program for Tax Year 2021.

It was founded in 2000 and has since become an active member of the American Fair Credit Council the US Chamber of Commerce and is accredited by the International Association of Professional Debt Arbitrators. Ad College Loans Rates Are Currently Amzaing. Applications must be submitted by September 15 2021.

Student Loan Debt Relief Tax Credit for Tax Year 2021. The Student Loan Debt Relief Tax Credit is a program created under 10. We are aware that student loan debt has become a growing concern among college graduates and wanted to remind you of a tax credit that you may be able to take advantage of.

Complete the Student Loan Debt Relief Tax Credit application. Maryland student loan tax credit 2021. There were 5145 applicants who attended in-state.

Its regrettable that the cost of higher education is. The Maryland Higher Education Commission MHEC is continuing their Student. September 3 2021.

The tax credits were divided into. But you need to act fast because the deadline to. About the Company Maryland Student Loan Debt Relief Tax Credit Application.

Currently owe at least a 5000 outstanding student loan debt balance. To be eligible you must claim Maryland residency for the 2021 tax year file 2021 Maryland state income taxes have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt upon applying for the tax credit. Applications for Student Loan Debt Relief due September 15 2021.

It was founded in 2000 and is a part of the American Fair Credit Council the US Chamber of Commerce and is accredited through the International Association of Professional Debt Arbitrators. April 16 2021 by Leave a Comment. Its regrettable that the cost of higher education is preventing many people from pursuing their college dreams Comptroller.

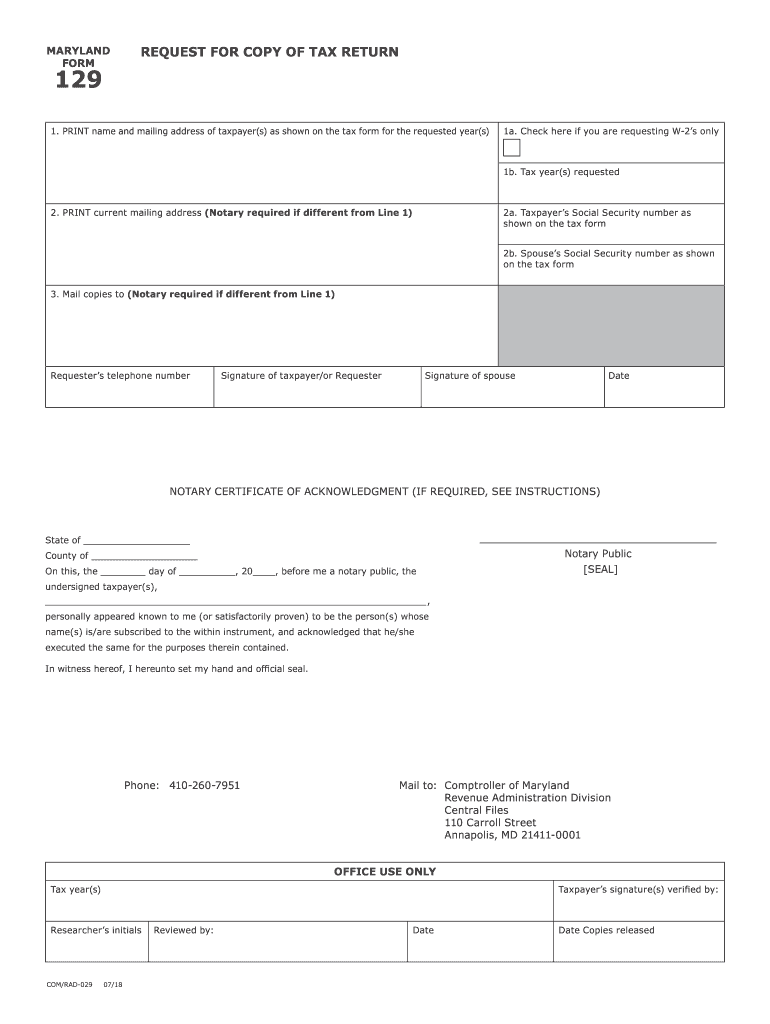

Download Maryland Tax Form 129 Fill Out And Sign Printable Pdf Template Signnow

Although There Are Lots Of Financial Reasons For Marriage Bonnie Koo Md Believes It Sometimes Makes Sen Reasons For Marriage Family Matters Unmarried Couples

Federal Income Tax Changes Married Filing Jointly Tax Brackets Federal Income Tax Income Tax

News Release Comptroller Franchot Urges Marylanders To Apply For Tax Credit

Md Income Tax Services Home Facebook

Maryland Smartbuy 3 0 Buy A Home Get Rid Of Student Loan Debt Student Loan Hero

Comptroller Of Maryland Facebook

How Do I Choose A 529 Morningstar 529 College Savings Plan Saving For College Bond Funds

Maryland Refundwhere S My Refund Maryland H R Block

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Maryland Student Loan Forgiveness Programs

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Comptroller Of Maryland Facebook

Nonprofit Student Loan Forgiveness Maryland Nonprofits

Opinion What Jealous S Plan To Tax The 1 Percent Means For Moco