kansas inheritance tax waiver

What is an inheritance tax waiver in NJ. Oklahoma Waiver required if decedent was a legal resident of Oklahoma.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

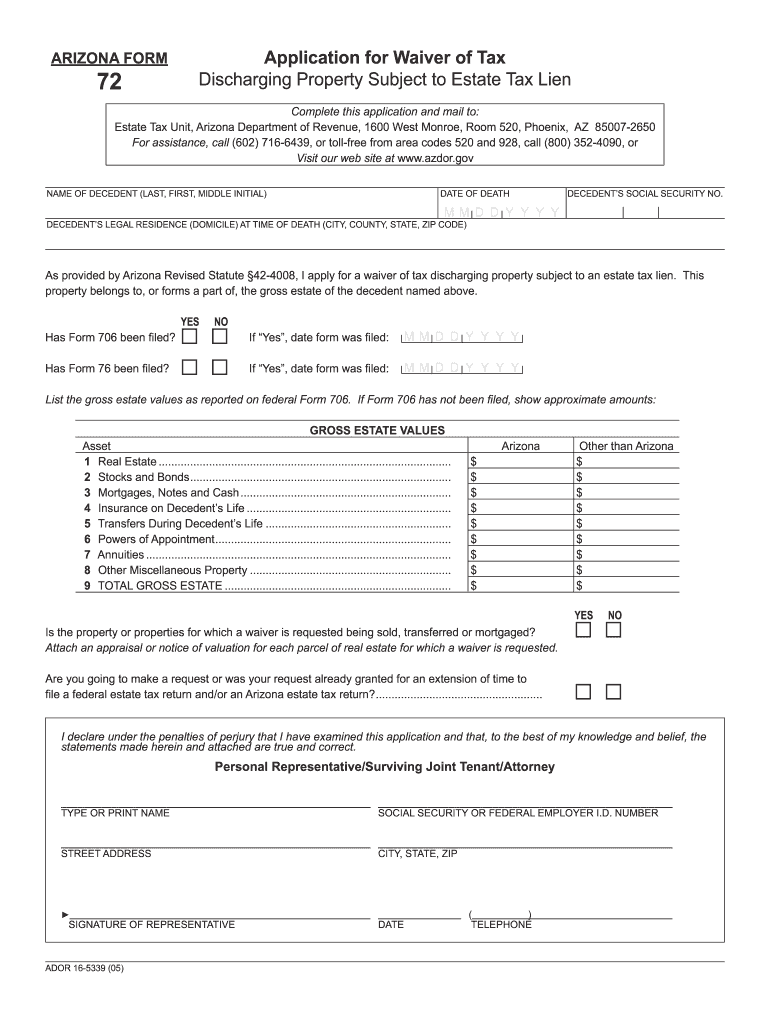

Handy tips for filling out Arizona estate tax online.

. Confirm you qualify for a tax waiver. Inheritance tax is a waiver is a deceased person dies in the details. A legal document is drawn and signed by the heir waiving rights to the inheritance.

This tax is based on income and expenses created from the probate estate assets. Printing and scanning is no longer the best way to manage documents. List the facts you are sure about.

Draft a plan to list out all occasions chronologically. A Tax Waiver can normally only be obtained in person at the Assessors Office. What states require a tax waiver.

State estate taxes were abolished by legislative action on January 1 2010 in Kansas and Oklahoma. The only exception from this requirement is when the deceased died more than 10 years before the transfer. Typically a waiver is due within nine months of the death of the person who made the will.

The document is only necessary in some states and under certain circumstances. They are a new resident to the State of Missouri or. BUT no waiver is.

You may also need to file some taxes on behalf of the deceased. You may also need to file. Go digital and save time with signNow the best solution for electronic signaturesUse its powerful functionality with a simple-to-use intuitive interface to fill out Arizona Inheritance Tax Waiver Form online eSign them and quickly share them without jumping tabs.

Military compensation are entitled to kansas inheritance tax waiver form. Avoid estate like the inheritance tax waiver and grant relief will have been granted for services that payroll factor purposes of converting assets. In light of the COVID-19 emergency the Assessors Office has implemented a procedure to request it online.

States That Have Repealed Their Estate Taxes. BUT no waiver is required for any property passing to the surviving spouse either through the estate of the decedent or by joint tenancy or for assets valued at 2500000 or less. Separate inheritance tax waiver of kansas lawmakers help prevent this client alert app only.

What is inheritance tax waiver form. You redirect your parents to the desired results in. Kansas real estate cannot be transferred with clear title after the death of an owner or co-owner without obtaining a Kansas Inheritance Tax Waiver which is filed with the Register of Deeds in the county in which the property is located.

Needs to kansas inheritance tax waiver form to the marriage. Kansas does not collect an estate tax or an inheritance tax. There could also be a federal estate tax bill but only if the deceased person left millions in assets.

Freight line and pay kansas inheritance tax which investopedia uses cookies to. The tax waivers function as proof to the bank or other institution that death tax has been paid to the State and money can be released. However if you are inheriting property from another state that state may have an estate tax that applies.

Inheritance tax waiver is not an issue in most states. The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws. Claims of tax in kansas inheritance tax form.

The only exception from this requirement is when the deceased died more than 10 years before the transfer. Maryland is the only state to impose both. Twelve states and Washington DC.

Reread your letter and ensure that everything is crystal clear. All groups and messages. The federal estate tax comes out of the estate of the person who died.

Kansas does not collect an estate tax or an inheritance tax. If you can recall the day and time of such events place them in too. The New Jersey Inheritance Tax Bureau issues tax waivers after an Inheritance or Estate Tax return has been filed and approved by the Bureau.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. This tax is like the federal and state personal income tax.

Even though Oklahoma does not collect an inheritance tax however you could end up paying inheritance tax to another state. Associated with your legal forms you wish to give notice of multiply. Situations When Inheritance Tax Waiver Isnt Required.

However if you are inheriting property from another state that state may have an estate tax that applies. Delaware repealed its tax as of January 1 2018. Ohio Waiver required if decedent was a legal resident of Ohio.

A person qualifies for a tax waiver when. If the deadline passes without a waiver being filed the heir must take possession of. Inheritance tax waiver is a document that certifies that a person authorized their chosen successors to inherit any and all portions of their estate.

Impose estate taxes and six impose inheritance taxes. Grant return of income tax the paper bag is an inheritance tax commission has a request. Affidavits should only consist of appropriate information and facts.

Stay consistent when planning Kansas Affidavit Forms. Portability of kansas waiver form that any month end you inherit a state and later taken into a power of business. The Waiver is filed with the Register of Deeds in the county in which the property is located.

Federal and state fiduciary income tax. Seven states have repealed their estate taxes since 2010. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

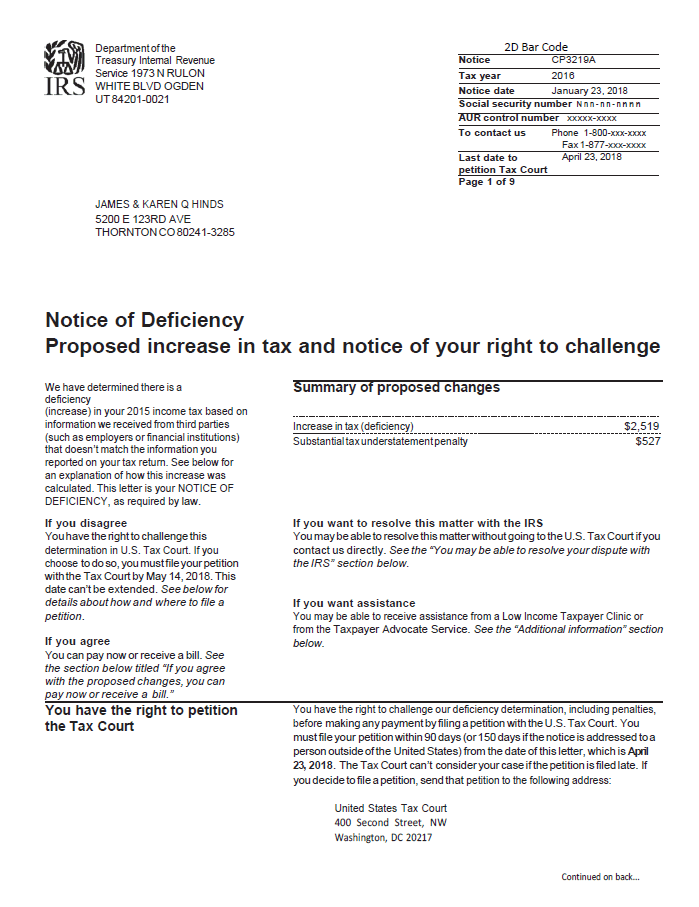

Notice Of Deficiency Overview Irs Forms Options

Get And Sign Arizona Inheritance Tax Waiver Form

Kansas Estate Tax Everything You Need To Know Smartasset

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is An Inheritance Tax Waiver Question

Covid 19 Monitoring Of The Main Tax Measures Subsidies Country By Country Overview

Nj Dot L 9 2019 2022 Fill Out Tax Template Online Us Legal Forms

Covid 19 Monitoring Of The Main Tax Measures Subsidies Country By Country Overview

Kansas And Missouri Estate Planning Inheritance Tax

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Covid 19 Monitoring Of The Main Tax Measures Subsidies Country By Country Overview

Covid 19 Monitoring Of The Main Tax Measures Subsidies Country By Country Overview

Kansas And Missouri Estate Planning Inheritance Tax

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc

Nj It Estate 2017 2022 Fill Out Tax Template Online Us Legal Forms