capital gains tax proposal effective date

If the proposal for raising the ordinary income tax rate to 396. The major tax increase proposals include.

Morningstar Moments 3 Things You May Have Missed Morningstar

The effective date for the proposal would be the date of enactment.

. The proposal would be effective for gain required to be recognized and for dividends received on or after the date of enactment. Iii From a top individual rate of 882 to rates ranging from 965 to 109. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on.

The loss of LTCG treatment is notably different from other major tax provisions in that the Green Book calls for an effective date of late April effectively rendering it retroactive. June 9 2021 Bernie Kent JD CPA PFS It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive. The Green Book indicated the capital gain hike would be effective for gains required to be recognized after the date of announcement xxvi.

On Friday the Treasury Departments detailed explanations of President Bidens 6 trillion budget confirmed the administration is seeking a retroactive effective date on a capital. April 27 2021 Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the individual capital gains rate effective on the date the. Gimigliano Principal Washington National Tax KPMG US 1 202-533-4022 Podcast overview President Biden has proposed a.

The House bill would apply the increase to gain recognized after September 13 2021. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28. May 14 2021 Listen Now 2623 Download Subscribe John P.

Raising the top individual rate to 396. The effective date for the capital gains tax hike would be April 28 2021 when the American Families plan was introduced. Raising the top capital gains rate to 396 for households with more than 1 million in.

The effective date for most of the proposals is Jan. Taxpayers can consider triggering gain before the potential effective date of a capital gains change but should assess the outlook carefully and understand the risk. 1 2022 except for the proposed increase in capital gains tax rates which would likely be effective retroactive to April.

The Treasury provided further detail and guidance into the matter through the release of its General Explanation of the Administrations Fiscal Year 2022 Revenue Proposalsie the. The effective date for most of the proposals is Jan. On April 28 2021 President Biden released the American Families Plan which included a proposal to increase the long-term capital gains tax rate for households with.

But the effective date.

As Tax Changes Brew In Congress Outlook Is Grim For Pass Through Owners

Capital Gains Full Report Tax Policy Center

Capital Gains Tax Strategies How To Protect Your Assets And Stay On Track For Retirement Cambridge Trust

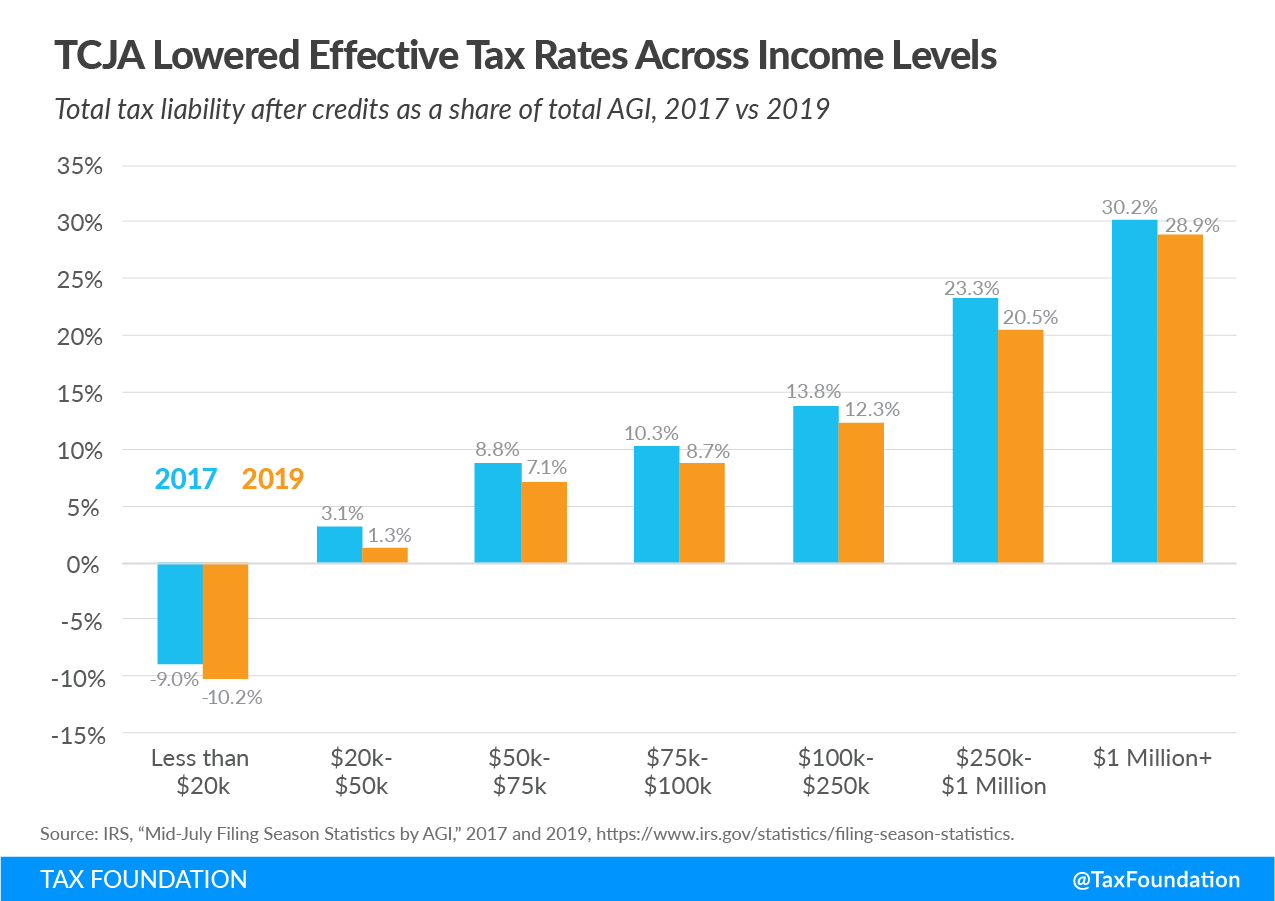

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

The Tax Reform Act Where Are We Now Ppt Download

An Overview Of Capital Gains Taxes Tax Foundation

Income Tax Law Changes What Advisors Need To Know

Qualified Small Business Stock Considerations For 100 Gain Exclusion

How Are Capital Gains Taxed Tax Policy Center

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

Trump Tax Cuts A Preliminary Look At 2019 Tax Data For Individuals

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

The Real Question On A Capital Gains Hike Is Whether It S Retroactive

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

How Biden S 2 Trillion In Tax Increases Target Companies And The Rich The New York Times

Congress Completes Reconciliation Bill With Key Tax Changes Our Insights Plante Moran

Effects Of Changing Tax Policy On Commercial Real Estate

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan